Weather news and local forecast

Glass account Opening Hours : Monday - Friday 8.30 am to 5.30 pm

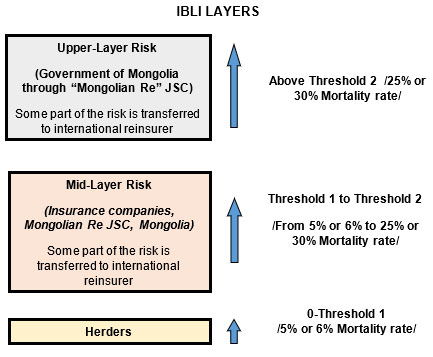

Index-Based Livestock Insurance (IBLI) is an insurance measure taken by the government to prevent herders from losing their livelihoods due to extreme weather and natural disasters and to support herders employment. IBLI is a special insurance that pays indemnity based on the mortality rate of each species of livestock in the whole soum level, but not on the mortality amount in one herder's livestock. Therefore, herders who insure their livestock in IBLI should understand that they will be indemnified only if the livestock mortality rate in the soum level exceed the threshold (5 or 6 percent of the total livestock amount for the each species of livestock.) due to dzud and other natural disasters.

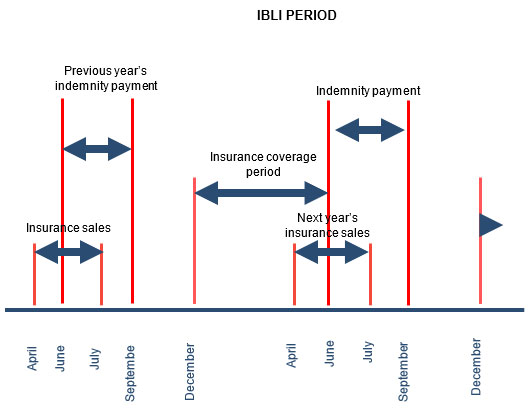

The period of IBLI sales is from January 1 to June 30. Except for this specified period, the insurance companies do not sell insurance policies to the herders.

Herders and herder households can buy livestock insurance from any insurance company /Insurance JSC, Bodi Insurance LLC, Mongol Insurance JSC, Monre Insurance LLC, Mig Insurance LLC, Munkh Insurance LLC, Nomin Insurance LLC, Practical Insurance LLC, Tenger Insurance LLC and Khan Insurancel LLC/ and intermediary bank branches /Khan Bank, State Bank/ in their province or soum.

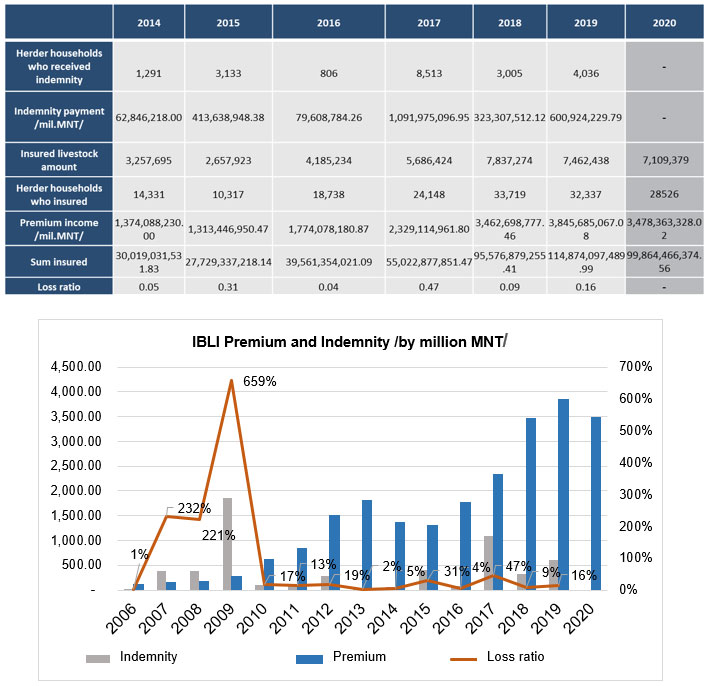

The sixth IBLI sales of National Reinsurance JSC (the fifteenth sales season of IBLI product since the sales started in 2005) started on January 1, 2020 in the level of 336 soums of 21 provinces and ended on June 30, 2020. Ard Insurance JSC, Bodi Insurance LLC, Mongol Insurance JSC, Monre Insurance LLC, Mig Insurance LLC, Munkh Insurance LLC, Nomin Insurance LLC, Practical Insurance LLC, Tenger Insurance LLC and Khan Insurancel LLC participated in the IBLI and sold insurance policies to 28,527 herders. 3.48 billion MNT was collected as insurance premium and State Bank and Khan bank provided insurance intermediary services. Insured herder households account for 16.62 percent of all herder households.

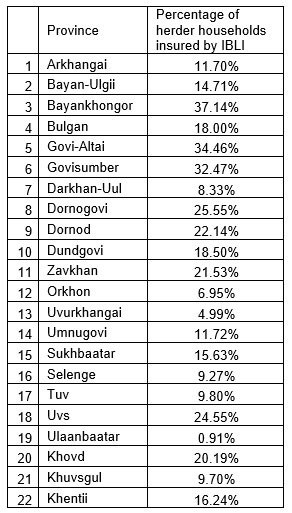

PERCENTAGE OF HERDER HOUSEHOLDS INSURED BY IBLI IN TOTAL AMOUNT OF HERDER HOUSEHOLDS /2020, BY PROVINCES/

Insured herder households account for 16.62 percent of all herder households, which is 2.4 percent less from the previous year.

In 2020, 28,526 herder and herder households insured their 7,109,379 livestock (10 percent of total livestock in Mongolia) paying 3,478,363,328.02 MNT as indemnity premium. Sum insured is 99,864,466,374.56 MNT.

Herder Mr.Jamts in Jargalant soum, Khovd province decided to meet the IBLI agent in his soum and buy insurance policy to insure his 18 horses.

A horse value is 650 000 MNT in the Khovd province, horse premium rate in Jargalant soum is 1.45 percent. Firstly, let’s estimate the sum insured of the Mr.Jamts’s horses and amount of insurance premium.

Sum insured = 18 x 650 000₮ = 11 700 000₮

МIf Mr. Jamts insured his horses for 100%:

Insurance premium = 11 700 000₮ х 1.45% = 169 650₮

If he does not have 169 650₮ MNT at the moment, he may lower the value. He valued his horses of 11 700 000 MNT for 8 000 000 MNT, let’s estimate the insurance premium.

Insurance premium to be paid = 8 000 000₮ х 1.45% = 116 000₮

It should be better if herders get used to choose their livestock value as it is on market.

Now, let’s estimate the indemnity. If the horse mortality rate in Jargalant soum in 2011 estimated by half year livestock census was 15 percent, the indemnity amount to be paid to Mr.Jamts is:

Percent to get indemnity = 15% - 5% = 10%

Indemnity to be paid to Mr. Jamts = 10% х 8 000 000 = 800 000₮

If he valued his horses for 100%

Indemnity = 10% х 11 700 000 = 1 170 000₮

If the mortality rate for horse in his soum is 5 percent, please consider that Mr. Jamts shall not receive any indemnity.